-

-

Featured Care Areas

Source: Shutterstock

Medical Insurance in Singapore is Changing

Last updated: Friday, March 26, 2021 | 6 min reading time

The Ministry of Health wants to put a stop to rising insurance premium costs. Here’s how they are going to do it.

On 7 March 2018, the Senior Minister of State for Health Chee Hong Tat made some pretty big announcements about medical insurance coverage in Singapore.

As of April 2019, you'll no longer be able to purchase Integrated Shield Plans that offer 100% coverage for hospitalisation and medical treatment.

Not sure what that means for you?

Call or WhatsApp Parkway Insurance Concierge at +65 9834 0999 to find out if your Integrated Shield Plan covers you and your loved ones at private hospitals like Mount Elizabeth Hospitals, Gleneagles Hospital, and Parkway East Hospital.

If you're unsure what is an Integrated Shield Plan, 'rider', and what these changes mean for you, read on for the full breakdown.

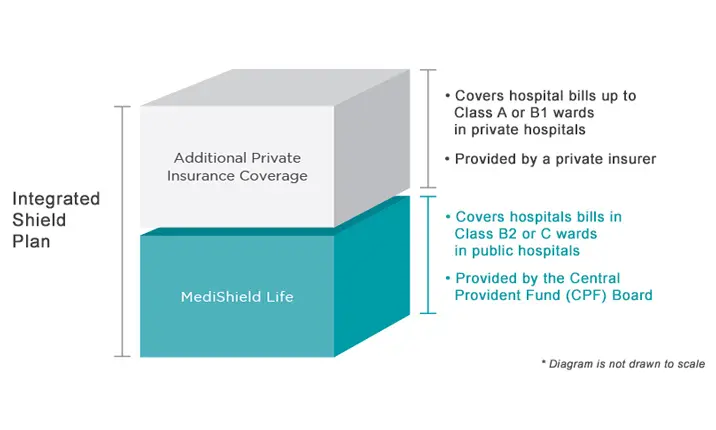

What is an Integrated Shield Plan?

Integrated Shield Plans offer an additional layer of coverage on top of your mandatory MediShield Life plan. They cover care up to standard single rooms at private hospitals such as Gleneagles Hospital, Mount Elizabeth Hospitals, and Parkway East Hospital.

If you have an Integrated Shield Plan (with a rider), you have the freedom to select the doctor you wish to see, enjoy the privacy of staying in a single room during your treatment, and additional coverage on medical costs before, during, and even after your hospitalisation.

If you have an Integrated Shield Plan, you can be covered for treatment at private hospitals. Examples of insurers in Singapore who offer Integrated Shield Plans include:

- AIA HealthShield Gold Max A

- Aviva MyShield Plan 1

- AXA Shield Plan A

- Great Eastern Supreme Health P Plus

- NTUC Enhanced IncomeShield Preferred

- Prudential PRUshield Premier

If you don't have an Integrated Shield Plan, you should seriously consider buying one to protect yourself from potentially hefty medical bills in the future. Whether you're considering to sign up for one or concerned if the recent changes affect your current insurance plan, read on to find out about the changes.

What is a rider?

Basically, insurance 'riders' are optional benefits built into your plan that you pay a little bit of extra money for.

Previously, all Integrated Shield Plans listed above offer a 'full rider' option. This was a popular choice in Singapore because it provides complete coverage for any insurance plan's deductible (the fixed amount you must pay before your insurance kicks in) and co-insurance (the percentage you must pay after your insurance kicks in).

Deductible for a private hospital with a regular Integrated Shield Plan, for example, is usually set at $3,500, while co-insurance is usually fixed at 10% of the remaining bill. If you opt for a full rider, you don't pay a cent, even if the total bill size is large.

Call or WhatsApp Parkway Insurance Concierge at +65 9834 0999 to find out if your Integrated Shield Plan covers you and your loved ones at private hospitals like Mount Elizabeth Hospitals, Gleneagles Hospital, and Parkway East Hospital.

So, what's all this got to do with the changes?

From 1 April 2019, Integrated Shield Plans with full riders are no longer available for you to purchase.

All 6 insurance providers who currently offer Integrated Shield Plans with full rider options (listed above) will need to launch partial riders instead, with a minimum co-payment of 5%.

So, in other words, if you choose to purchase an Integrated Shield Plan after 1 April 2019, a full rider won't be an option. You will have to pay at least a 5% co-payment for hospitalisation and medical treatment.

Will the co-payment be capped?

Yes. If you seek prior approval from your insurer and opt for treatment within their medical network, co-payment costs will usually be capped at $3,000 per year.

Bear in mind, though, that some insurers may choose to set their cap higher than $3,000.

But why has this change been made?

The cost of healthcare has been rising steadily over the years. In the last 2 years alone, insurance premiums have grown by up to 225%.

The Ministry of Health believes this is because of 'buffet syndrome'. Basically, there are too many people claiming unnecessary or overly expensive procedures using their full riders, which in turn is driving up insurance premium costs for the general public.

In fact, in 2016, the average medical bill size for policyholders with full riders was around 60% higher than the average bill size for policyholders without them.

The Ministry of Health hopes this new change will lower average medical bill sizes, therefore keeping premium costs down, and in the long term, result in more savings for you.

I already have an Integrated Shield Plan with a full rider. What does this mean for me?

If you're one of the 1.1 million Singaporeans who bought an Integrated Shield Plan with a full rider before 8 March 2018, you will not* be affected by this change.

Your insurer must continue to honour the contract they have with you.

However, it's important to be aware that all the insurers are reviewing the current policy plans and can change your coverage at any time, providing they let you know 31 days in advance.

If this happens, you will have the option to cancel your contract.

Of course, if you'd rather go ahead and switch to the new rider format in 2019, you can. But remember to check that your pre-existing conditions are still covered after the switch. You'll just need to start paying the required co-payment for any hospitalisation and treatment charges incurred.

*As of 31 March 2021. Please check with your insurance agent for exact coverage and policy changes

I'm planning to buy an Integrated Shield Plan later down the line. What does this mean for me?

If you purchase an Integrated Shield Plan after 1 April 2019, your coverage will include at least 5% co-payment for hospitalisation and medical treatment.

The exact percentage you need to pay should be clear before you sign any contracts.

OK. So, let's say I'm going to need to pay 5% – what might that cost me in practice?

Concerned about what a 5% co-payment might mean for you? Here's an example based on an inpatient procedure with hospitalisation:

- You have been advised by a doctor to go for an ovarian cystectomy, a minimally invasive procedure to remove an ovarian tumour.

- With an AIA HealthShield Gold Max A plan and VitaHealth A rider, the treatment and 2-day stay at a single room at Mount Elizabeth Hospital (Orchard) would usually cost about $21,947 (including hospital fees, doctor fees and GST, and at 50th percentile – meaning half of patients pay less than this amount) to treat this.

- With a 5% co-payment, you'd have to pay about $1,097 out-of-pocket (for panel doctors).

Get an estimate of your out-of-pocket expenses for common surgical procedures (with a single-room stay) at Mount Elizabeth Hospitals, Gleneagles Hospital, and Parkway East Hospital.

I'm still a bit confused about all this. What should I do?

Remember, if you've had a full rider since before 8 March 2018, your coverage won't change*.

If you do intend to change your plan, make sure you check that pre-existing conditions will be covered if you a) switch to a new insurance provider, or b) upgrade your plan with your current provider.

You can also call or WhatsApp Parkway Insurance Concierge at +65 9834 0999 to find out if your Integrated Shield Plan covers you and your loved ones at private hospitals like Mount Elizabeth Hospitals, Gleneagles Hospital, and Parkway East Hospital.

Finally, learn more about Integrated Shield Plans, and how they can help to pay for your medical bills at private hospitals.

Get an estimate of your out-of-pocket expenses for common surgical procedures (with a single-room stay) at Mount Elizabeth Hospitals, Gleneagles Hospital, and Parkway East Hospital.

*As of 31 March 2021. Please check with your insurance agent for exact coverage and policy changes

Baker, J. A. (2018, 7 March). 5% Co-Payment for New Integrated Shield Plan Riders to Help Address Over-Consumption of Medical Services. Retrieved 24 April 2018 from https://www.channelnewsasia.com/news/singapore/5-per-cent-co-payment-new-integrated-shield-riders-10021398

Ho, T. (2018, 12 March). 5 Facts About the Latest Integrated Shield Plan Changes that Singaporeans Need to Know. Retrieved 24 April 2018 from https://sg.finance.yahoo.com/news/5-facts-latest-integrated-shield-002046065.html

Ng, K. (2018, 24 April). Co-payment Mandated for New Insurance Riders in Bid to Curb ‘Buffet Syndrome’. Retrieved 24 April 2018 from https://www.todayonline.com/singapore/5-co-payment-required-all-new-integrated-shield-plans-full-riders-moh

Ho, T. (2018, 12 March). 5 Facts About the Latest Integrated Shield Plan Changes that Singaporeans Need to Know. Retrieved 24 April 2018 from https://sg.finance.yahoo.com/news/5-facts-latest-integrated-shield-002046065.html

Ng, K. (2018, 24 April). Co-payment Mandated for New Insurance Riders in Bid to Curb ‘Buffet Syndrome’. Retrieved 24 April 2018 from https://www.todayonline.com/singapore/5-co-payment-required-all-new-integrated-shield-plans-full-riders-moh